💰 Discover the 2026 federal income tax brackets! Learn how new IRS changes, inflation adjustments & deductions impact your taxes.

What are Tax Brackets?

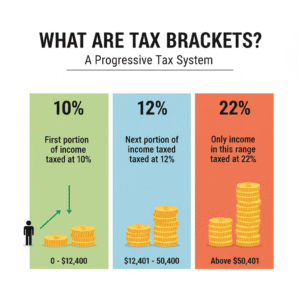

Ever heard someone say, “I’m in the 24% tax bracket so everything I earn gets taxed at 24%”? That’s a common belief — but it’s simply not how it works. The U.S. uses a progressive tax system, meaning your income is taxed in layers or “brackets.” IRS+1

The myth of “one rate for all”

Here’s the trick: only the portion of your income that falls into a higher bracket is taxed at that rate. If you make enough to hit the 24% bracket, you don’t pay 24% on all your income — just on the chunk in that bracket.

Progressive tax system explained

-

Your first dollars are taxed at the lowest rate.

-

As your taxable income moves up, you “enter” higher brackets for only that extra income.

-

The result: your marginal tax rate (rate on the next dollar) is different from your effective tax rate (what you actually pay divided by total income). NerdWallet+1

Why tax brackets matter for your finances

Marginal vs. effective tax rate

Let’s say you earn an extra $1,000. If that extra pushes you into a higher bracket, only that $1,000 is taxed at the higher rate — not your entire income. Your effective tax rate might be much lower than your highest bracket suggests.

Example: Single filer scenario

If you’re a single filer and your taxable income is $50,000, you’ll pay:

-

10% on first chunk,

-

12% on next chunk,

-

maybe 22% on income above some threshold.

Hence your overall rate might land at ~12%-13% effective.

2026 Tax Brackets & Rates Overview

Let’s get the facts: for tax year 2026, the seven tax rates remain the familiar 10%, 12%, 22%, 24%, 32%, 35%, and 37%. U.S. Bank+3The Wall Street Journal+3MarketWatch+3

Inflation adjustment and “bracket creep”

What’s new is the income thresholds for each bracket — they’re being bumped up to reflect inflation, so you need more income to fall into a higher rate. This aims to prevent “bracket creep” (when inflation alone pushes you into a higher bracket without increasing real purchasing power). MarketWatch+1

Tax Brackets by Filing Status

Here are some of the key numbers for 2026:

Single Filers

-

10%: $0 to $12,400

-

12%: $12,401 to $50,400

-

22%: $50,401 to $105,700

-

24%: $105,701 to $201,775

-

32%: $201,776 to $256,225

-

35%: $256,226 to $640,600

-

37%: over $640,601 The Wall Street Journal+1

Married Filing Jointly

-

10%: $0 to $24,800

-

12%: $24,801 to $100,800

-

22%: $100,801 to $211,100

-

24%: $211,401 to $403,550

-

32%: $403,551 to $512,450

-

35%: $512,451 to $768,700

-

37%: over $768,701 The Wall Street Journal+1

Heads of Household & other statuses

The tables are similar but with different thresholds. For example, heads of households in 2026 might have their own bracket windows. (Exact numbers vary; always check IRS tables.) e-File+2Peterson & Associates, P.S.+2

Standard Deduction & Key Adjustments for 2026

Standard deduction amounts

-

Single filers: $16,100 The Wall Street Journal+1

-

Married filing jointly: $32,200 The Wall Street Journal+1

-

Heads of households: $24,150 The Wall Street Journal+1

These raise the portion of income that isn’t taxed at all, which is great news.

Personal exemptions, credits & other changes

-

Personal exemptions remain at $0 (no per-dependent deduction like older law) Kiplinger+2The Wall Street Journal+2

-

Adoption credit: max ~$17,670 for 2026 The Wall Street Journal+1

-

Foreign earned income exclusion: ~$132,900 for 2026 The Wall Street Journal+1

-

Child tax credit remains ~$2,200 per qualifying child for many families The Wall Street Journal+1

-

SALT (state & local tax) deduction cap increased to ~$40,400 (for some filers) The Wall Street Journal+1

Other Tax‐Provision Adjustments for 2026

Alternative Minimum Tax (AMT) changes

AMT thresholds, exemptions and phase-out points are also indexed for inflation. This matters especially for high-income earners. Kiplinger+1

Earned Income Tax Credit (EITC), adoption credit, foreign earned income exclusion

As mentioned above, several of these credits/deductions are increasing for inflation or law changes. Good to keep track. The Wall Street Journal+1

State & Local Tax (SALT) deduction changes

One of the big recent changes: for 2026, the cap on SALT deduction is relaxed (up to ~$40,000 for some filers) but has phase-outs. So if you live in a high-tax state, this might help. Kiplinger

What These Changes Mean for You

Who benefits most?

-

Middle-income earners with moderate income growth — inflation adjustments may keep them from bumping into higher brackets.

-

Families who can fully use standard deduction + credits.

-

Residents of high-tax states (SALT cap relief) might see relief.

-

Older taxpayers & those with dependents who get higher deductions/credits.

Who might still pay more?

-

High earners whose income grows faster than inflation.

-

Those in very high brackets (32%, 35%, 37%) may still owe significant tax.

-

Taxpayers with complex itemized deductions might not fully benefit from standard deduction increases.

-

Those subject to AMT, or with large non-wage income (investment, business) need planning.

Tax Planning Tips for 2026

Withholding & estimated tax considerations

If your bracket changes (or your income grows), update your W-4 or estimated tax payments so you don’t get hit by underpayment penalties.

Deductions, credits, timing income & expenses

-

Consider bunching deductions (charitable giving, medical expenses) to maximize benefit.

-

Timing matters — defer or accelerate income/expenses depending on bracket.

-

Use credits (child credit, adoption, education) whenever possible.

Retirement contributions & other shelters

-

Maximize 401(k), IRA, HSA contributions: those reduce taxable income.

-

Be aware of changes in “catch-up” rules for high earners in 2026. the-sun.com

-

Business owners/self-employed: consider SEP-IRA, Solo 401(k), retirement planning.

Common Pitfalls & Misunderstandings

“I entered a higher bracket => I pay that rate on all income”

Nope — only the portion in that bracket is taxed at that rate.

Overlooking changes like AMT or phase-outs

Even though the brackets and deductions are improving for many, other rules like AMT, phase-outs for credits, or additional Medicare tax can bite you.

Example Calculations for Typical Scenarios

Single filer earning $80,000 taxable income

Let’s assume taxable income (after standard deduction & exemptions) is $80K. You’ll pay low rates on the first chunk and higher rate on remainder. Effective rate might be well below 22%.

Married couple taxable income $300,000

After deduction, credits, etc., you’ll apply bracket layers. Some of that income falls into 24% and 32% rates. Plan deduction timing and contributions carefully.

What to Watch in Future Years

Legislative sunset risks

Certain tax laws are scheduled to expire or be reviewed. Political changes could shift brackets, rates, or deductions. (E.g., some analysts worry about changes post-2026) cbo.gov+1

Inflation indexing & further adjustments

Each year income thresholds usually bump up for inflation. Stay updated. Tools and IRS announcements matter.

Resources & Tools You Can Use

IRS tables & worksheets

Use official resources from Internal Revenue Service (IRS) to get accurate brackets, standard deductions, worksheets. IRS+1

Tax planning software & advisors

Tax-software tools, financial planners or tax advisors can help you optimize based on your specific situation.

Conclusion

Tyling your taxes with the 2026 brackets in mind gives you a real chance to plan smart rather than just “see what happens.” With the progressive tax system, inflation adjustments, rising standard deductions and changing credits, the key is preparation. Use the tools, keep an eye on your income and expenses, and make decisions that help you keep more of what you earn — instead of losing it to surprise tax bills.

FAQs

-

Do tax rates themselves change for 2026?

No — the seven rates (10%, 12%, 22%, 24%, 32%, 35%, 37%) remain the same. What changes are the income thresholds. The Wall Street Journal+1 -

If I get a pay raise, will I pay much more tax?

Not necessarily. Only the higher portion of income is taxed at the higher bracket. Still, plan ahead for withholding/estimated tax adjustments. -

Does the standard deduction change each year?

Yes — it’s adjusted for inflation and via law. For 2026, the standard deduction is higher vs prior years. The Wall Street Journal+1 -

What if I have side income (freelance, gig work)?

That counts toward your taxable income. Make sure you account for it (self-employment tax, estimated payments) so you don’t get surprised. -

Should I consult a tax professional for 2026?

If you have more than simple wage income, business income, large deductions/credits, or high income — yes, a tax professional is a smart move.